avtoelektrik71.ru

Learn

Fractional Purchase

Schwab Stock Slices™ is an easy way to buy fractional shares for a set dollar cost. You can buy shares from up to ten S&P ® companies for $5 each. With fractional ownership, the investor is buying into a tangible asset. In other words, you actually own shares in the title to the property. What are the. Buy a 25% or 50% share of a luxury home at sea. Fractional options are now available for global living. Fractional ownership allows for easier access to real estate investment. Instead of bearing the entire financial burden of a whole property, individuals can. Schedule a consultation with our international fractional purchase or sale lawyers to get the confidence and peace of mind to execute your aviation dreams. Stash breaks down whole investments into smaller, more affordable pieces—called fractional shares. That way, you don't have to pay for an entire expensive share. How does fractional ownership work? · There will be a manager or sponsor who will form a legal ownership entity and then acquire the assets like a building or. Fractional real estate investing is the process of buying shares in an individual property or real estate fund. In other words, you're investing in a small. Fractional ownership is where two or more people choose to co-own an asset benefitting from shared costs and benefits. Schwab Stock Slices™ is an easy way to buy fractional shares for a set dollar cost. You can buy shares from up to ten S&P ® companies for $5 each. With fractional ownership, the investor is buying into a tangible asset. In other words, you actually own shares in the title to the property. What are the. Buy a 25% or 50% share of a luxury home at sea. Fractional options are now available for global living. Fractional ownership allows for easier access to real estate investment. Instead of bearing the entire financial burden of a whole property, individuals can. Schedule a consultation with our international fractional purchase or sale lawyers to get the confidence and peace of mind to execute your aviation dreams. Stash breaks down whole investments into smaller, more affordable pieces—called fractional shares. That way, you don't have to pay for an entire expensive share. How does fractional ownership work? · There will be a manager or sponsor who will form a legal ownership entity and then acquire the assets like a building or. Fractional real estate investing is the process of buying shares in an individual property or real estate fund. In other words, you're investing in a small. Fractional ownership is where two or more people choose to co-own an asset benefitting from shared costs and benefits.

Under this type of agreement, each party owns a portion (or “fraction”) of the property that corresponds to their share of the purchase price. It allows buyers. Even if you're buying only a portion of a full share, there are a few downsides and risks associated with fractional ownership. Not every brokerage offers. Selling an existing fraction is similar to selling any other real estate asset. However, there are a few key differences and specificities to consider. Private jet fractional ownership at Flexjet embodies unparalleled freedom and peace of mind. It delivers, inclusively, what most providers simply cannot. Timeshare units are usually split into 52 weeks, but fractional ownership properties are split into smaller sections. As a result, owners have the chance to. Fractional ownership is a combination of timeshare and real estate, where the owner owns part of the deeded title to a vacation property. Fractional share investing can be extremely affordable and lets the average investor buy a stake in companies that may be out of their price range otherwise. Fractional ownership is where two or more people choose to co-own an asset benefitting from shared costs and benefits. If a stock is trading at $1, per share, but you only want to invest $, you can use that $ to buy 1/5th of a share. How are fractional shares made. A fractional share is a share of equity that is less than one full share, which may occur as a result of stock splits, mergers, or acquisitions. Fractional Ownership in Business. Fractional ownership is the sharing of a certain asset class among shareholders or owners. Get Started - It's free! Fractional. The fractional ownership investment model allows multiple individuals to collectively own a high-value asset, such as real estate, aircraft, art, or other. This new trading feature lets you buy the stock of companies or ETFs based on a dollar amount, as opposed to how many whole shares you are able to buy. Fractional shares allow you to buy a fraction of a share. They are a great way to diversify your portfolio and add variety to your investments. Buy pieces of your favorite companies with Stock Fractions, now part of WellsTrade, the do-it-yourself investing platform in the Wells Fargo Mobile® app. Fractional share investing can be extremely affordable and lets the average investor buy a stake in companies that may be out of their price range otherwise. Fractional ownership is where two or more people choose to co-own an asset benefitting from shared costs and benefits. You can buy partial ownership in a property. That could mean direct ownership, where your name appears on the deed alongside other owners. Fractional ownership is used to describe shared ownership of a vacation or resort property by people in an arrangement which allocates usage rights based on. Fractional selling means identifying more prospects, making more sales presentations, signing more sales contracts and closing more transactions.

Wholesaler And Manufacturer

10 Reasons Why Suppliers Sell Thru Wholesalers · Transportation efficiencies. · Wholesalers break bulk. · Just-in-time inventory. · Consolidated sourcing. Manufacturing and wholesaling businesses produce and sell foods by wholesale with a limited or no retail sales business component. A wholesaler works more closely with retailers to match their needs through buying products in bulk at a discount. The distributor does perform some of the same. A wholesaler purchases products from a supplier or produces goods themselves before selling them to store owners in bulk. These businesses then market and sell. Wholesale refers to a type of business that buys large quantities of goods directly from manufacturers or distributors and resells them to other businesses. Wholesalers and manufacturers must obtain a federal permit to operate. Licensed manufacturers can distribute their products through licensed wholesalers. When you buy merchandise from a wholesaler, you're shopping from the middleman between your retail store and the manufacturer. A wholesale purchase is almost. The role of the middleman has significantly shrunk. Losing the middleman means lower prices for consumers and higher profitability for manufacturers. Wholesaling is the act of buying a large number of goods directly from a manufacturer and then selling them to retailers. Wholesalers buy in bulk at a. 10 Reasons Why Suppliers Sell Thru Wholesalers · Transportation efficiencies. · Wholesalers break bulk. · Just-in-time inventory. · Consolidated sourcing. Manufacturing and wholesaling businesses produce and sell foods by wholesale with a limited or no retail sales business component. A wholesaler works more closely with retailers to match their needs through buying products in bulk at a discount. The distributor does perform some of the same. A wholesaler purchases products from a supplier or produces goods themselves before selling them to store owners in bulk. These businesses then market and sell. Wholesale refers to a type of business that buys large quantities of goods directly from manufacturers or distributors and resells them to other businesses. Wholesalers and manufacturers must obtain a federal permit to operate. Licensed manufacturers can distribute their products through licensed wholesalers. When you buy merchandise from a wholesaler, you're shopping from the middleman between your retail store and the manufacturer. A wholesale purchase is almost. The role of the middleman has significantly shrunk. Losing the middleman means lower prices for consumers and higher profitability for manufacturers. Wholesaling is the act of buying a large number of goods directly from a manufacturer and then selling them to retailers. Wholesalers buy in bulk at a.

Distributors are responsible for liaising with wholesalers or even suppliers and offering them good pricing based on the quantities needed. Explain the services offered by wholesalers to manufacturers. Manufacturer Partners. 0 +. We make it easy. By working with GMD, we provide you with access to the entire Canadian retail market – both brick & mortar and. Wholesalers and manufacturers must obtain a federal permit to operate. Licensed manufacturers can distribute their products through licensed wholesalers. Wholesalers buy large quantities of products from the manufacturer or distributor. Whether the companies offer wholesale gifts or clothing, the. The wholesaler, acting as a crucial intermediary in the supply chain, buys inventory in volume from manufacturers or suppliers and then resells them to. Manufacturing and wholesaling businesses produce and sell foods by wholesale with a limited or no retail sales business component. A wholesaler is a company or individual that purchases great quantities of products from manufacturers, farmers, other producers, and vendors. Discuss services of retailer to manufacturer and wholesaler. A wholesaler is a company that buys and sells goods in bulk. They serve as a link between manufacturers and retailers. Wholesalers purchase products in large. Some manufacturers are also distributors and wholesalers; in this case, you'd buy wholesale items directly from the manufacturer. Apple and Nike, for example. Getting any product from manufacture to purchase by a consumer involves a supply chain. The distributor is the manufacture's direct point of contact for. Discuss services of retailer to manufacturer and wholesaler. Wholesalers typically have less of a profit margin when selling to retailers. While the percentage range will vary depending on the product, wholesalers will. A wholesaler is a person or company that acts as an intermediary in the supply chain and helps distribute commodities from source to end user. America's Leading B2B Directory · Featured Suppliers · Recommended Suppliers · Reach over , active wholesale buyers each month. · Wholesale Product Directory. The role of the middleman has significantly shrunk. Losing the middleman means lower prices for consumers and higher profitability for manufacturers. There are two price schedules: the wholesale schedule of prices charged by manufacturers to licensed wholesalers; and the retail schedule of prices charges by. Wholesalers and manufacturers must obtain a federal permit to operate. Licensed manufacturers can distribute their products through licensed wholesalers. Wholesaling or distributing is the sale of goods or merchandise to retailers; to industrial, commercial, institutional or other professional business users;.

Ceo Of Fidelity

Chairman & CEO: Edward F. Manzi Jr. A Webster, Massachusetts native, Ed Manzi graduated Magna Cum Laude from the University of Massachusetts Lowell with a B.S. Former Chairman of Fidelity Investments, Edward C. Johnson 3d and his father, the founder of the company, established the Fidelity Foundation, a private. Abigail P. Johnson. Chairman and CEO at Fidelity Investments. View articles by Abigail P. Johnson. The time to double down on digital assets. June 24, Bill Foley. Non-Executive Chairman of the Board ; Randy Quirk. Executive Vice-Chairman of the Board ; Mike Nolan. Chief Executive Officer ; Tony Park. Chief. Edward C. Johnson 3d becomes chairman and CEO of FMR Corp. Fidelity offers its first individual retirement account (IRA) a year after passage of the. Appointed as Fidelity CEO by father Edward Johnson. Latest News. Source: Bloomberg reporting. Methodology: The. I asked if Abigail would write me a letter as to why I should keep my business with fidelity.. and why would my request for compensation be ignored? Abigail Johnson serves as the CEO / President of Fidelity Investments. Rachael Brumund serves as the Vice President of Fidelity Investments. Rachael started. In , Abigail Johnson became president and CEO of Fidelity Investments (FMR) and chairman of Fidelity International (FIL). "Abigail Johnson Named CEO of. Chairman & CEO: Edward F. Manzi Jr. A Webster, Massachusetts native, Ed Manzi graduated Magna Cum Laude from the University of Massachusetts Lowell with a B.S. Former Chairman of Fidelity Investments, Edward C. Johnson 3d and his father, the founder of the company, established the Fidelity Foundation, a private. Abigail P. Johnson. Chairman and CEO at Fidelity Investments. View articles by Abigail P. Johnson. The time to double down on digital assets. June 24, Bill Foley. Non-Executive Chairman of the Board ; Randy Quirk. Executive Vice-Chairman of the Board ; Mike Nolan. Chief Executive Officer ; Tony Park. Chief. Edward C. Johnson 3d becomes chairman and CEO of FMR Corp. Fidelity offers its first individual retirement account (IRA) a year after passage of the. Appointed as Fidelity CEO by father Edward Johnson. Latest News. Source: Bloomberg reporting. Methodology: The. I asked if Abigail would write me a letter as to why I should keep my business with fidelity.. and why would my request for compensation be ignored? Abigail Johnson serves as the CEO / President of Fidelity Investments. Rachael Brumund serves as the Vice President of Fidelity Investments. Rachael started. In , Abigail Johnson became president and CEO of Fidelity Investments (FMR) and chairman of Fidelity International (FIL). "Abigail Johnson Named CEO of.

Abigail Johnson. CEO of Fidelity. Chairman of Fidelity International; President of Fidelity Investments. Fee Range: $20, - $50, Topics: CEO Keynote. Abigail Johnson, CEO of Fidelity Investments, leading one of the world's largest financial services companies. Cast your vote for Abigail as one of Money's. Since , Johnson has been president and chief executive officer (CEO) of American investment firm Fidelity Investments (FMR), and chair of its former sister. Abigail P. Johnson is Chairman and Chief Executive Officer of Fidelity Investments, a · Experience: Fidelity Investments · Education: Harvard Business. Abby Johnson CEO runs financial services giant with low profile her family has kept since founding it 74 years ago. About Abigail Johnson. Abigail Johnson has served as CEO of Fidelity Investments since , when she took over for her father, and has been chairman since. Fidelity Investments's Chairman and CEO is Abby Johnson. Other executives include Kevin Barry, Chief Financial Officer; Michael Gabree, CIO. Prior to joining Fidelity, Rajeev was CEO, Asia Pacific for PineBridge Investments. Andrew Wells. Vice Chairman, Fidelity Canada. Andrew has over 20 years. Abigail Johnson, CEO of @Fidelity Investments, leads one of the world's largest financial services companies! Vote for Abigail as one of. Overall, Abigail Johnson's tenure as CEO of Fidelity Investments has been marked by a spirit of innovation, inclusivity, and excellence. She has led the company. CEO Abigail Johnson rotates top talent yet again on the back of the fund company's robust performance. FEB 08, By Leo Almazora. Leo Almazora. Abigail P. "Abby" Johnson became chairman of FMR LLC, in addition to being named chief executive officer in She is the third generation to lead the. Abigail Johnson Named CEO of Fidelity Investments. Kirsten Grind was first to report that Fidelity Investments had promoted Abigail Johnson to the position of. Appointed as Fidelity CEO by father Edward Johnson. Latest News. Source: Bloomberg reporting. Methodology: The. Abigail Johnson - CEO of Fidelity Investments. Abigail Johnson serves as the CEO / President of Fidelity Investments. Rachael Brumund serves as the Vice President of Fidelity Investments. Rachael started. At Fidelity, we value how Diversity, Equity & Inclusion (DEI) helps us to deliver for our customers, drive innovation, and maintain a welcoming culture. Aaron has carried forward his family's leadership at Fidelity Bank into a fourth generation, serving as both president and chief executive officer. Abigail Johnson is the Chairman and CEO of Fidelity. Abigail Johnson attended Harvard Business School. View Abigail Johnson at Fidelity on The Org.

Metal Prices Chart 2021

Graph and download economic data for Producer Price Index by Commodity: Metals and Metal Products: Cold Rolled Steel Sheet and Strip (WPU) from Jun. There is growing sentiment that a price bottom could be near as mill input cost have leveled off. However. demand conditions remain soft. Hot rolled prices. What is Your Metal Worth? · Historical Price Charts. Gold; Silver; Platinum; Palladium · Ratio Charts. Gold to Silver Ratio; Gold to Oil Ratio; Gold to Platinum. Over metals prices, news and analysis on the global ferrous and non-ferrous markets, including steel, aluminum, copper, nickel, rare earths and more. Subscribe for instant access to the latest World Stainless Steel Prices. Specific tables for markets that matter to your business. 3 years historical data. Prices for iron ore are forecast to decline from current levels to average $/metric ton in July before sliding through the third quarter to end of Historically, HRC Steel reached an all time high of in September of HRC Steel is expected to trade at USD/T by the end of this quarter. Some Details About This Table. The carbon steel should-cost models contain detailed price adders and extras for a full range of steel grades including: A Metals & Minerals Price Index is at a current level of , down from last month and up from one year ago. This is a change of % from last. Graph and download economic data for Producer Price Index by Commodity: Metals and Metal Products: Cold Rolled Steel Sheet and Strip (WPU) from Jun. There is growing sentiment that a price bottom could be near as mill input cost have leveled off. However. demand conditions remain soft. Hot rolled prices. What is Your Metal Worth? · Historical Price Charts. Gold; Silver; Platinum; Palladium · Ratio Charts. Gold to Silver Ratio; Gold to Oil Ratio; Gold to Platinum. Over metals prices, news and analysis on the global ferrous and non-ferrous markets, including steel, aluminum, copper, nickel, rare earths and more. Subscribe for instant access to the latest World Stainless Steel Prices. Specific tables for markets that matter to your business. 3 years historical data. Prices for iron ore are forecast to decline from current levels to average $/metric ton in July before sliding through the third quarter to end of Historically, HRC Steel reached an all time high of in September of HRC Steel is expected to trade at USD/T by the end of this quarter. Some Details About This Table. The carbon steel should-cost models contain detailed price adders and extras for a full range of steel grades including: A Metals & Minerals Price Index is at a current level of , down from last month and up from one year ago. This is a change of % from last.

Steel Scrap Futures historical prices: closing price, open, high, low, change and %change of the Steel Scrap Futures for the selected range of dates. Steel (USA) prices averaged USD per metric ton in July, down % from June. On 31 July, the commodity traded at USD per metric ton, up % from Some Details About This Table. Depending on whether or not a company buys mill-direct or through service centers, having access to a comprehensive models for. STEEL | A complete NYSE American Steel Index index overview by MarketWatch Even the Can Will Cost More This Year. Nov. 25, at a.m. ET by Barron's. Graph and download economic data for Producer Price Index by Commodity: Metals and Metal Products: Iron and Steel (WPU) from Jan to Jul about. A licence is required from IBA in order to obtain and use real-time or historical LBMA Gold and Silver Price data, including for pricing and valuation. Scrap metal prices in Canada varies across provinces, we have averaged all sources across different scrap metal dealerships to provide you with the below. Metals & Minerals Price Index is at a current level of , down from last month and up from one year ago. This is a change of % from. Metals Prices for this date are also available in the listed currencies In the price of Rhodium reached almost $30, per oz. Metal Price Charts. The London Metal Exchange (LME) is the world centre for industrial metals trading. Historically, Steel reached an all time high of in May of Steel - data, forecasts, historical chart - was last updated on September 3 of Steel. , $, $, $, $, $, %. , $, $, $, $, $, %. , $, $, $, $ Producer Price Index - Metals and metal products ; Go to web page with historical data for series WPU ; · · Prices for iron ore are forecast to decline from current levels to average $/metric ton in July before sliding through the third quarter to end of Current and historical Copper prices, stocks and monthly averages LME market structure evolution Our range of proposals designed to enable the. chart and compare the metal market prices that matter to you. Buyers and 04/01/ 0 50 dollars per tonne, dollars per. View price reports, history, forecasts and upates on steel and stainless steel products from global commodity research group CRU, including latest HRC. Follow the prices of precious metals (gold, silver, platinum, palladium) in the major currencies. Live quotes, price history and performance of precious. , January, $ , $ , $ 1, ; , December, $ , $ , $ 1, ; , November, $ , $ , $ 1, Charts and data files. April (zip), Pandemic, War, Recession: Drivers of Aluminum and Copper Prices October Using this Data. Summary terms of use.

How Much Money Is In Student Loans

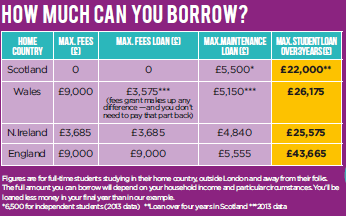

That makes about $ trillion in student loan debt, the vast majority of which is from federal student loans. That's no small chunk of change. But how much. If you're an international student looking to study in Canada but need additional money This is why many students rely on a loan to cover the remaining costs. As of September , forty-three million U.S. borrowers collectively owed more than $ trillion in federal student loans. Adding private loans brings that. But unpaid interest can add up in some situations, such as if you're on an income-driven repayment (IDR) plan or if you're not making payments. When does unpaid. If you don't apply until July or August, your loan money will most likely be There is a common misconception that since the winter term is so far into the. How does interest work on my student loan? That depends on where you are Where can I see how much interest I've paid on my student loan? Check your. Student loan debt has proliferated since , totaling $ trillion by July In , students who borrowed to complete a bachelor's degree had about. Many students believe they won't qualify for financial aid because their parents make too much money, but in reality the formula to determine eligibility. Decide how much to borrow in student loans for college. Make a plan to borrow money for college that you'll be able to repay later. That makes about $ trillion in student loan debt, the vast majority of which is from federal student loans. That's no small chunk of change. But how much. If you're an international student looking to study in Canada but need additional money This is why many students rely on a loan to cover the remaining costs. As of September , forty-three million U.S. borrowers collectively owed more than $ trillion in federal student loans. Adding private loans brings that. But unpaid interest can add up in some situations, such as if you're on an income-driven repayment (IDR) plan or if you're not making payments. When does unpaid. If you don't apply until July or August, your loan money will most likely be There is a common misconception that since the winter term is so far into the. How does interest work on my student loan? That depends on where you are Where can I see how much interest I've paid on my student loan? Check your. Student loan debt has proliferated since , totaling $ trillion by July In , students who borrowed to complete a bachelor's degree had about. Many students believe they won't qualify for financial aid because their parents make too much money, but in reality the formula to determine eligibility. Decide how much to borrow in student loans for college. Make a plan to borrow money for college that you'll be able to repay later.

Key Takeaways · The total amount of outstanding student loan debt in the United States was $ trillion as of Q4' · Soaring college costs and pressure to. Since the loan payments total $ a year (at % interest on a ten-year loan), during the next year you'd have about $5, available to pay for college costs. Student Assistance for Part-Time studies. Loans and Grants from the Canada Student Financial Assistance Program. The federal government provides Student. Student loans make up more than $ trillion in outstanding debt in the United States from over 42 million borrowers. Packages of student loans are being. The average federal student loan debt is $ In total, about 43 million Americans share $ trillion in federal student loan debt. student money monthly). All students who apply for government student many students will have a mix of student loan and grant funding. The most. student loans in the U.S. are few and far between. However, private money towards the reduction of existing student loans without penalty. about. Student loans can come from the federal government, from private sources such as a bank or financial institution, or from other organizations. Federal student. Maximum loans for an 8-month academic year is $13,; more funding is available for higher cost programs and professional programs. Interest Payments While in. What is your total loan debt? $. How long do Applies only to federal and provincial student loans for full-time OSAP. Does not apply to provincial loans. Overall, the average annual loan amount awarded to first-time, full-time degree/certificate-seeking undergraduate students who received student loans decreased. Though college graduates who borrowed to pay for school took out, on average, $ less in loans compared with the prior year, the average total student. Check out our TD Student Chequing Account with no monthly fee to house your grant or loan money. Student Budget Calculator and find out how much your school. After your loan application is processed, you'll receive a student award letter from your provincial student loan provider. It explains how much money you. But unpaid interest can add up in some situations, such as if you're on an income-driven repayment (IDR) plan or if you're not making payments. When does unpaid. The Loan Repayment Estimator can help you estimate the monthly payments you will need to make to repay your Canada Student Loan or other government student. To calculate your student loan payments, enter the loan amount, anticipated interest rate, and term of the loan (how many years you have to pay it back). This. One of the most important things to know about student loans is that it's not free money. You will need to pay back the balance in full at some point. The average student loan debt is just over $37,, according to data from the Department of Education. There is approximately $ trillion in outstanding. The Government of New Brunswick provides New Brunswick Student Loan funding up to $ per week of study.

How Much Do I Pay In Capital Gains Tax

Gains you make from selling assets you've held for a year or less are called short-term capital gains, and they generally are taxed at the same rate as your. If this amount is within the basic Income Tax band, you'll pay 10% on your gains (or 18% on residential property and carried interest). You'll pay 20% on any. Capital gains tax in Canada for individuals will realize 50% of the value of any capital gains as taxable income for amounts up to $, Any amount above. In other words, for tax year , you won't pay any capital gains tax if your total taxable income is $44, or less and you're filing individually. You'll. 15% tax capital gain * · 25% tax on depreciation recapture ** · State tax capital gain *** · 0% NII tax · Total hypothetical taxes · Net amount for Reinvestment. Each state may also have a capital gains tax, but each treats them slightly differently. States with No Capital Gains Taxes. If you have a large number of. Depending on your regular income tax bracket, your tax rate for long-term capital gains could be as low as 0%. Even taxpayers in the top income tax bracket pay. Capital gains are generally included in taxable income, but in most cases, are taxed at a lower rate. A capital gain is realized when a capital asset is sold or. Long-term capital gains are taxed at three different rates: 0%, 15%, or 20%. The amount you'll pay depends on your taxable income and tax filing status As. Gains you make from selling assets you've held for a year or less are called short-term capital gains, and they generally are taxed at the same rate as your. If this amount is within the basic Income Tax band, you'll pay 10% on your gains (or 18% on residential property and carried interest). You'll pay 20% on any. Capital gains tax in Canada for individuals will realize 50% of the value of any capital gains as taxable income for amounts up to $, Any amount above. In other words, for tax year , you won't pay any capital gains tax if your total taxable income is $44, or less and you're filing individually. You'll. 15% tax capital gain * · 25% tax on depreciation recapture ** · State tax capital gain *** · 0% NII tax · Total hypothetical taxes · Net amount for Reinvestment. Each state may also have a capital gains tax, but each treats them slightly differently. States with No Capital Gains Taxes. If you have a large number of. Depending on your regular income tax bracket, your tax rate for long-term capital gains could be as low as 0%. Even taxpayers in the top income tax bracket pay. Capital gains are generally included in taxable income, but in most cases, are taxed at a lower rate. A capital gain is realized when a capital asset is sold or. Long-term capital gains are taxed at three different rates: 0%, 15%, or 20%. The amount you'll pay depends on your taxable income and tax filing status As.

The tax must be paid by electronic funds transfer or other form of department authorized electronic payment, such as by credit card. The department may. In the United States, individuals and corporations pay a tax on the net total of all their capital gains. The tax rate depends on both the investor's tax. Updated Capital gains tax by state table for each state in the country and D.C.. Capital gains state tax rates displayed include federal max rate at. An individual's net capital gains are taxed at the rate of 7%. Dividends and interest income are taxed at a rate based on Connecticut Adjusted Gross Income. The. A capital gains tax is a tax imposed on the sale of an asset. The long-term capital gains tax rates for the 20tax years are 0%, 15%, or 20% of the. If you do have to pay capital gains tax, how much you owe will depend on how long you owned the house, your filing status, and your income. Selling a house you'. How to Figure Out the Amount of Your Profit That Will Be Taxed For starters, you have to pay capital gains taxes only if you have a so called "taxable gain". Long-term capital gains on investments held for more than a year are taxed at the rate of 0%, 15% or 20%, depending on your taxable income and tax filing. Although capital gains taxes typically apply to the returns from any capital asset, including housing, U.S. homeowners benefit from a generous exemption for. In most cases, capital gains tax is paid after selling an asset (like stocks or real estate). This usually happens when you file your tax return for the. How to Calculate Capital Gains When you sell property, stocks or other assets, you can calculate your capital gains simply by subtracting the amount you paid. When you sell investments at a higher price than what you paid for them, the capital gains are "realized" and you'll owe taxes on the amount of the profit. If you are single, you will pay no capital gains tax on the first $, of profit (excess over cost basis). Married couples enjoy a $, exemption Using a capital gains tax calculator will help you determine the total tax you need to pay on any profit, known as capital gain, you've earned through the. For single folks, you can benefit from the 0% capital gains rate if you have an income below $44, in Most single people will fall into the 15% capital. Generally, the Investment Income Tax for capital gains is 10%. Argentina (Last reviewed 13 May ), Capital gains are subject to the normal CIT rate. Just like income tax, you'll pay a tiered tax rate on your capital gains. For example, a single person with a total short-term capital gain of $15, would pay. Short-term capital gains are taxed at your ordinary income tax rate. You'll pay somewhere between 10% and 37% of your short-term capital gains depending on your. While all capital gains are taxable and must be reported on your tax return, only capital tax payments if you have a taxable capital gain. Refer to. Short term gains on stock investments are taxed at your regular tax rate; long term gains are taxed at 15% for most tax brackets, and zero for the lowest two.

How To Buy Muni Bonds Directly

Municipal bonds: $5, with additional purchases in increments of $5, The information does not usually directly identify you, but it can give you a more. Conversely, selling municipal bonds generally involves a bid solicitation process. Specifically, when a customer decides to sell a municipal bond and places an. Municipal Bonds: Understanding Credit Risk (PDF) Learn more about assessing credit risks when purchasing municipal bonds in this SEC investor bulletin. If you do not have a brokerage account, you will need to open one in order to purchase bonds. You will need to have an account with one of the firms. An investor can buy and sell bonds directly through an online brokerage account. They also can be purchased through a full-service brokerage or a bank. Another. Bonds cannot be purchased directly from the State. Brokers submit investors' orders for bonds in specific amounts and maturity dates based on approximate. Investors must have an open brokerage account in advance of the bond sale to place orders for the bonds. 2) Research the bonds: Before purchasing a New York. Probably the easiest way to buy municipal bonds is to use direct online trading. You create an online account with a broker-dealer, and you are in control of. How to Buy Vermont Tax Exempt Bonds The State does not sell bonds directly. You must buy these bonds through a registered broker/dealer. These bonds may be. Municipal bonds: $5, with additional purchases in increments of $5, The information does not usually directly identify you, but it can give you a more. Conversely, selling municipal bonds generally involves a bid solicitation process. Specifically, when a customer decides to sell a municipal bond and places an. Municipal Bonds: Understanding Credit Risk (PDF) Learn more about assessing credit risks when purchasing municipal bonds in this SEC investor bulletin. If you do not have a brokerage account, you will need to open one in order to purchase bonds. You will need to have an account with one of the firms. An investor can buy and sell bonds directly through an online brokerage account. They also can be purchased through a full-service brokerage or a bank. Another. Bonds cannot be purchased directly from the State. Brokers submit investors' orders for bonds in specific amounts and maturity dates based on approximate. Investors must have an open brokerage account in advance of the bond sale to place orders for the bonds. 2) Research the bonds: Before purchasing a New York. Probably the easiest way to buy municipal bonds is to use direct online trading. You create an online account with a broker-dealer, and you are in control of. How to Buy Vermont Tax Exempt Bonds The State does not sell bonds directly. You must buy these bonds through a registered broker/dealer. These bonds may be.

Bond calls are less likely when interest rates are stable or moving higher. Many municipal bonds are “callable,” so investors who want to hold a municipal bond. How do you buy a municipal bond? · Using the services of a broker-dealer or bank that deals municipal securities · Hire an investment advisor to locate and trade. How to buy municipal bonds Our market analysts conduct a rigorous review and approval process before making municipal bonds available to our investors. Information about tax-advantaged bonds, including tax-exempt, tax credit and direct pay bonds. Resources for issuers, borrowers and bond professionals. Buy. bond (the “par value”) at the bond's maturity date. Millions of U.S. taxpayers buy municipal bonds either directly or through separately managed accounts. Investment minimums for municipal bonds are typically $5, per bond, so an investor with limited funds to invest and who is seeking exposure to a wide range. Some of these risks are lessened by purchasing shares of a municipal bond fund, which are inherently diversified. Most municipal bond funds invest in the. It's easy to find the tax-free municipal bonds you are looking for and to purchase them online or through an FMSbonds specialist. Call FMS-BOND. About 72 percent of bonds are owned by individuals directly or through mutual funds and the like. Why do investors buy municipal bonds? Investors purchase. General obligation bonds account for 28% of the investment-grade muni market and are usually backed by the taxing authority of the bond issuer. Most states and. U.S. government savings bonds can only be purchased online using the TreasuryDirect website. You will need the name and Social Security number of the child for. Before buying an insured municipal bond, consider the credit rating of both the insurer and the underlying issuer. Liquidity. Vanguard Brokerage Services® doesn. The New York Municipal Bond Fund invests primarily in investment-grade municipal bonds bond at maturity over the basis of such bond immediately after. Before buying an insured municipal bond, consider the credit rating Build America Bonds (BABs) and Direct Pay Bonds are subject to an early redemption. In addition, municipal bond interest for bonds issued in U.S. territories is The information does not usually directly identify you, but it can give you a. Investors can put their money in individual bonds, a bond ladder strategy that consists of a series of bonds with different interest rates and maturity dates. Individuals can buy Town of Cary bonds from registered broker dealers. CUSIP Numbers. A bond's CUSIP is an alphanumeric identification code, usually nine. The Municipal Securities Rulemaking Board (MSRB) has educational information on muni bond investing For Treasury bonds, if you bought directly from the U.S. Are you curious how to buy or sell an existing municipal bond? Watch this invest directly in new issue municipal bonds. Read this article or watch. 2. Use a brokerage account. To buy muni bonds, corporate bonds, or Treasury bond funds, you usually need to work with a broker. You can.